China Communications Services Corporation Limited Annual Report 2015

136

NOTES TO THE

CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2015

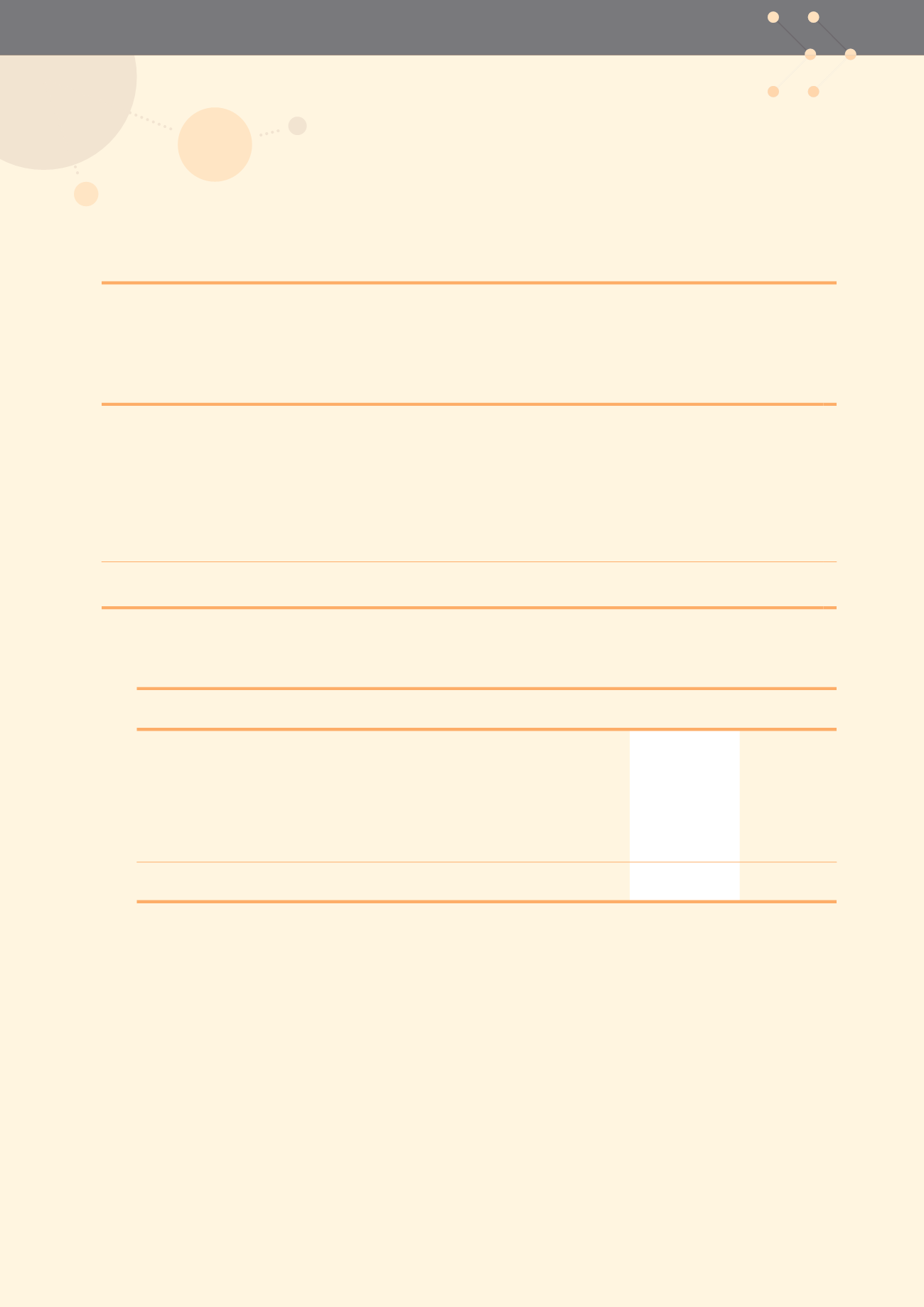

24. DEFERRED TAX ASSETS AND LIABILITIES

(continued)

As at

1 January

2014

Recognised in

profit or loss

Recognised in

other

comprehensive

income

As at

31 December

2014

RMB’000

RMB’000

RMB’000

RMB’000

(note 10(a))

Impairment losses, primarily for receivables

and inventories

94,008

45,233

—

139,241

Revaluation of property, plant and equipment

(12,195)

846

—

(11,349)

Unused tax losses (note (i))

28,015

11,089

—

39,104

Change in fair value (note (ii))

(4,697)

—

(1,535)

(6,232)

Unpaid expenses

169,755

(16,246)

—

153,509

Others

—

4,224

—

4,224

Deferred tax assets and (liabilities)

274,886

45,146

(1,535)

318,497

Notes:

(i)

Expiry of recognised tax losses

2015

2014

RMB’000

RMB’000

Year of expiry

2015

—

—

2016

—

8,169

2017

33,759

75,487

2018

51,529

66,535

2019

53,193

94,273

2020

3,042

—

141,523

244,464

(ii)

As at 31 December 2015, the Group’s deferred tax liability related to the change in fair value of available-for-sale financial assets reflects in the above

table.

(iii)

As at 31 December 2015, the Group has not recognised deferred tax assets in respect of tax losses of RMB941.0 million (2014: RMB714.1 million) as it

is not probable that future taxable profits against which the losses can be utilised will be available. The tax losses can be carried forward for five years

from the year incurred and hence will be expired from 2016 to 2020.