China Communications Services Corporation Limited Annual Report 2015

145

NOTES TO THE

CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2015

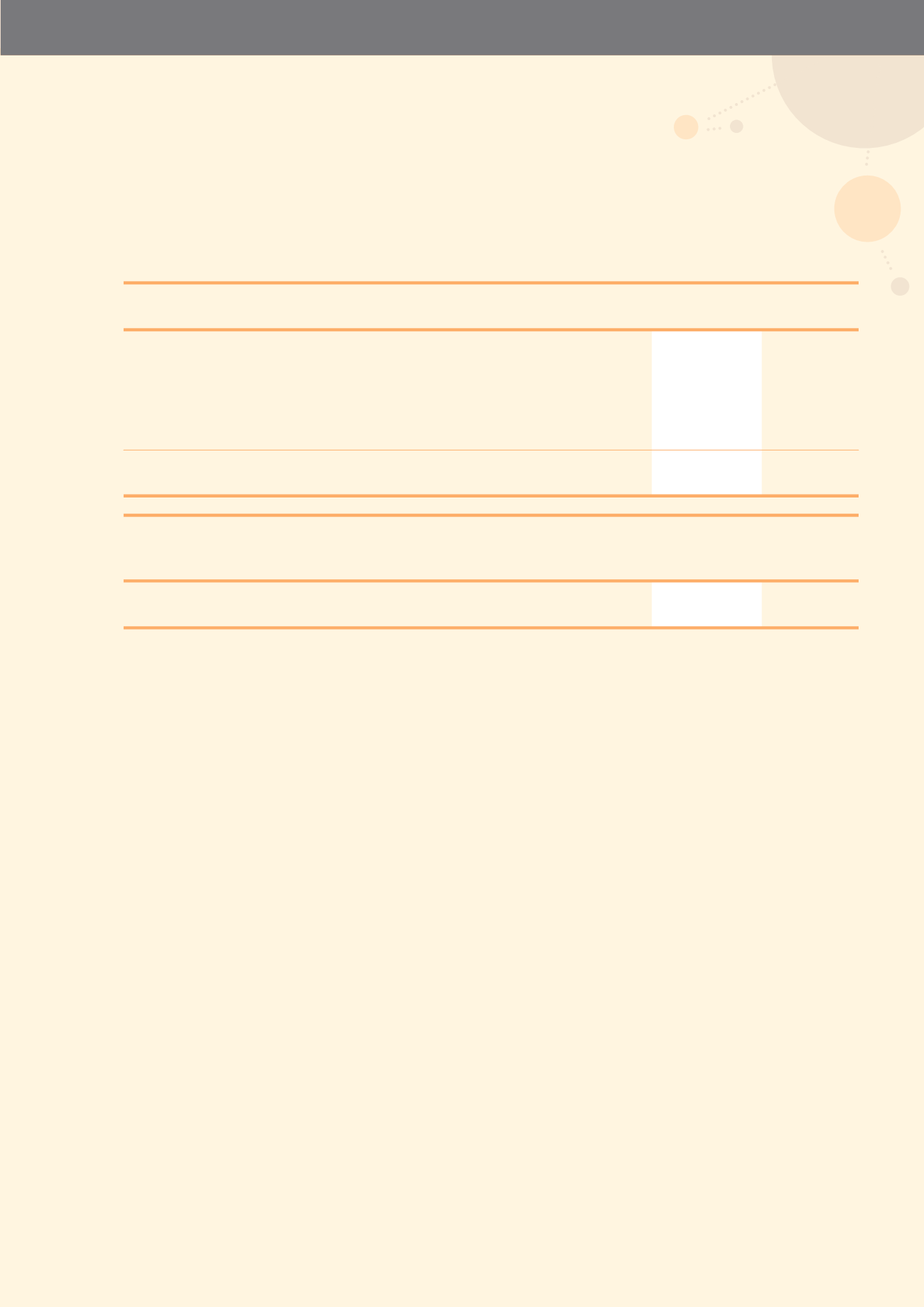

36. SHARE CAPITAL

2015

2014

RMB’000

RMB’000

Registered, issued and fully paid:

4,534,598,160 (31 December 2014: 4,534,598,160)

domestic shares of RMB1.00 each

4,534,598

4,534,598

2,391,420,240 (31 December 2014: 2,391,420,240)

H shares of RMB1.00 each

2,391,420

2,391,420

6,926,018

6,926,018

2015

2014

Thousand

Thousand

shares

shares

At 1 January and 31 December

6,926,018

6,926,018

All shareholders are entitled to receive dividends as declared from time to time and are entitled to one vote per share at

meetings of the Company. All shares rank equally with regard to the Company’s residual assets.

(a) Capital management

The Group’s primary objectives when managing capital are to safeguard the Group’s ability to continue as a going

concern, so that it can continue to provide returns for shareholders and benefits for other stakeholders, by

strengthening their leading position as integrated service provider to the telecommunications industry and achieving

economies of scale in the market.

The Group actively and regularly reviews and manages its capital structure to maintain a balance between higher

shareholder returns that might be possible with higher levels of borrowings and the advantages and security afforded

by a sound capital position, and makes adjustments to the capital structure in light of changes in economic

conditions.

The Group monitors its capital using a gearing ratio which is total debts divided by the sum of total debts and total

equity. For this purpose, the Group defines total debt as the sum of short-term interest bearing borrowings, long-

term interest bearing borrowings and convertible preference shares and preference shares. The Group aims to

maintain the gearing ratio at a reasonable level. The Group’s ratio as at 31 December 2015 was 3.4% (2014: 3.8%).

In order to maintain or adjust the ratio, the Group may adjust the amount of dividends paid to shareholders, issue

new shares, return capital to shareholders, raise new debt financing or sell assets to reduce debt.