China Communications Services Corporation Limited Annual Report 2015

138

NOTES TO THE

CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2015

27. ACCOUNTS AND BILLS RECEIVABLE, NET

(continued)

(b)

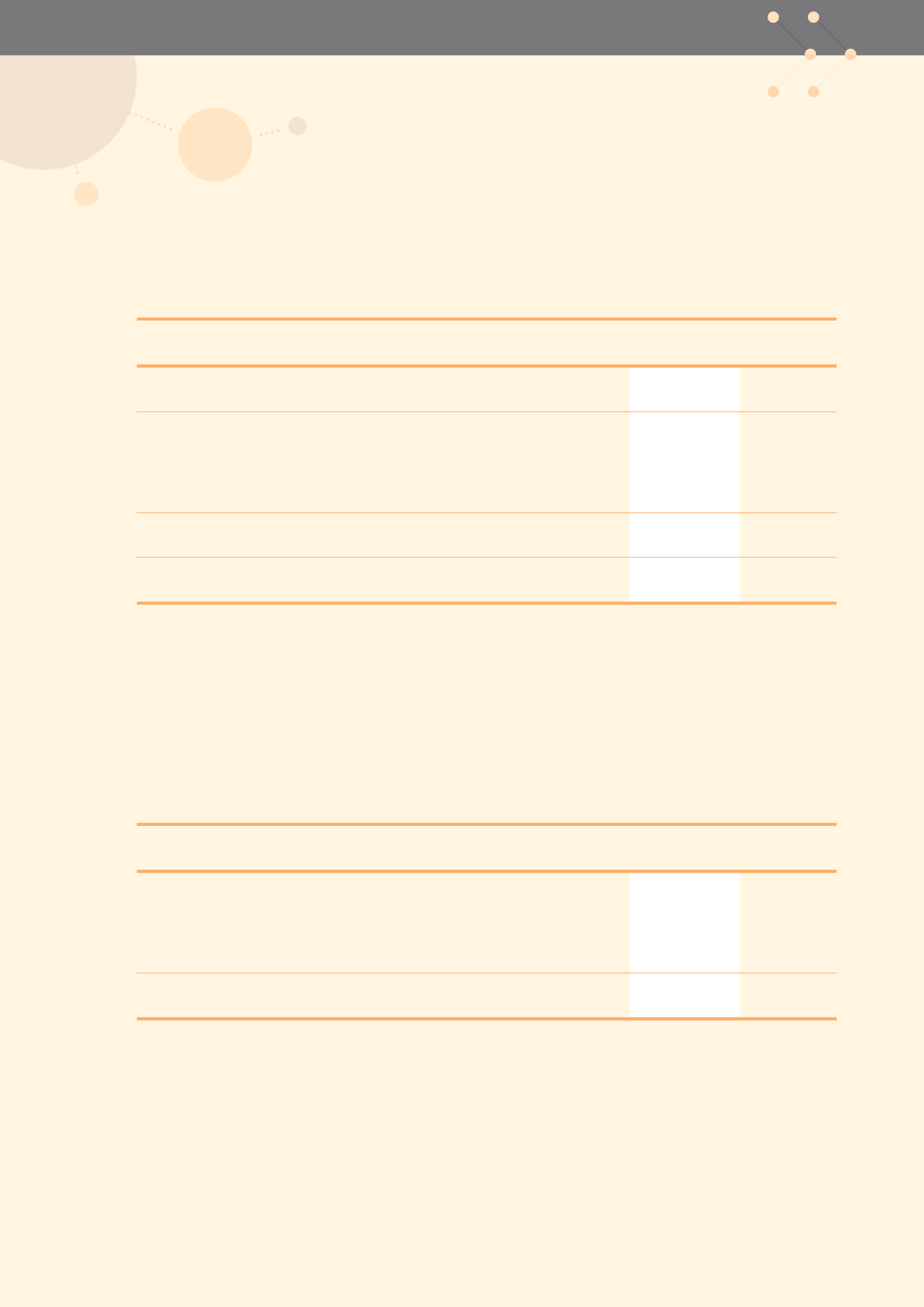

The ageing analysis of accounts and bills receivable (net of impairment losses) based on credit terms is as follows:

2015

2014

RMB’000

RMB’000

Current (note)

13,211,725

13,536,273

Within 1 year

11,666,256

11,228,501

After 1 year but less than 2 years

2,131,351

1,938,198

After 2 years but less than 3 years

511,497

648,426

After 3 years

—

89,800

Amount past due

14,309,104

13,904,925

27,520,829

27,441,198

Note: Including revenues within the credit terms for contract work.

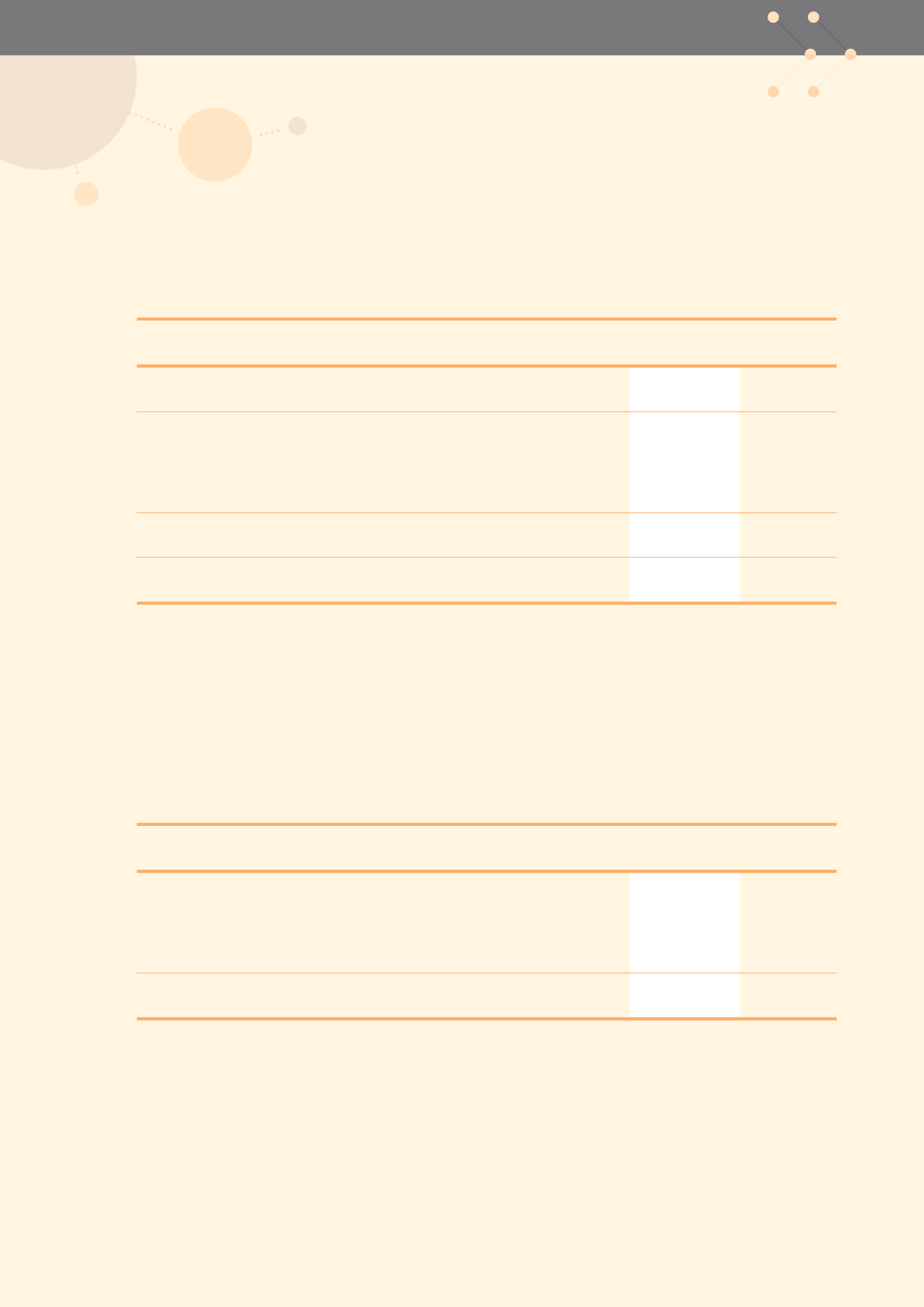

(c) Impairment of accounts and bills receivable

Impairment losses in respect of accounts and bills receivable are recorded using an allowance account unless the

Group is satisfied that recovery of the amount is remote, in which case the impairment loss is written off against

accounts and bills receivable directly (see note 2(l)(i)).

The movement in allowance for doubtful debts during the year, including both specific and collective loss

components, is as follows:

2015

2014

RMB’000

RMB’000

At 1 January

624,376

372,576

Impairment loss recognised

577,101

295,706

Reversal of impairment loss previously recognised

(101,648)

(34,208)

Uncollectible amounts written off

(18,452)

(9,698)

At 31 December

1,081,377

624,376

At 31 December 2015, accounts and bills receivable of RMB1,421 million (2014: RMB2,152 million) were individually

determined to be impaired. The individually impaired receivables related to customers that were in financial difficulties

and management assessed that only a portion of the receivables is expected to be recovered. Consequently, specific

impairment losses of RMB511 million (2014: RMB317 million) were recognised. The Group does not hold any

collateral over these balances.